Tata Trusts Backs Chandrasekaran for Third Term

Trusts sidestep retirement policy as internal rifts surface over board appointments and spotlight old corporate dramas.

Topics

News

- AI May Add More Than $500 Billion to India’s Core Sectors by 2035, PwC Says

- India Generates 20% of Global Data but Hosts Just 3% of Data Centres

- Google Disrupts Major Residential Proxy Network Linked to Global Cybercrime

- Economic Survey 2026 Stresses on Age-Based Access to Curb Digital Addiction

- Economic Survey 2026 Pitches Skills as the Backbone of India’s Demographic Dividend

- Perplexity Taps Microsoft Azure in $750M Deal as AI Agent Battle With Amazon Intensifies

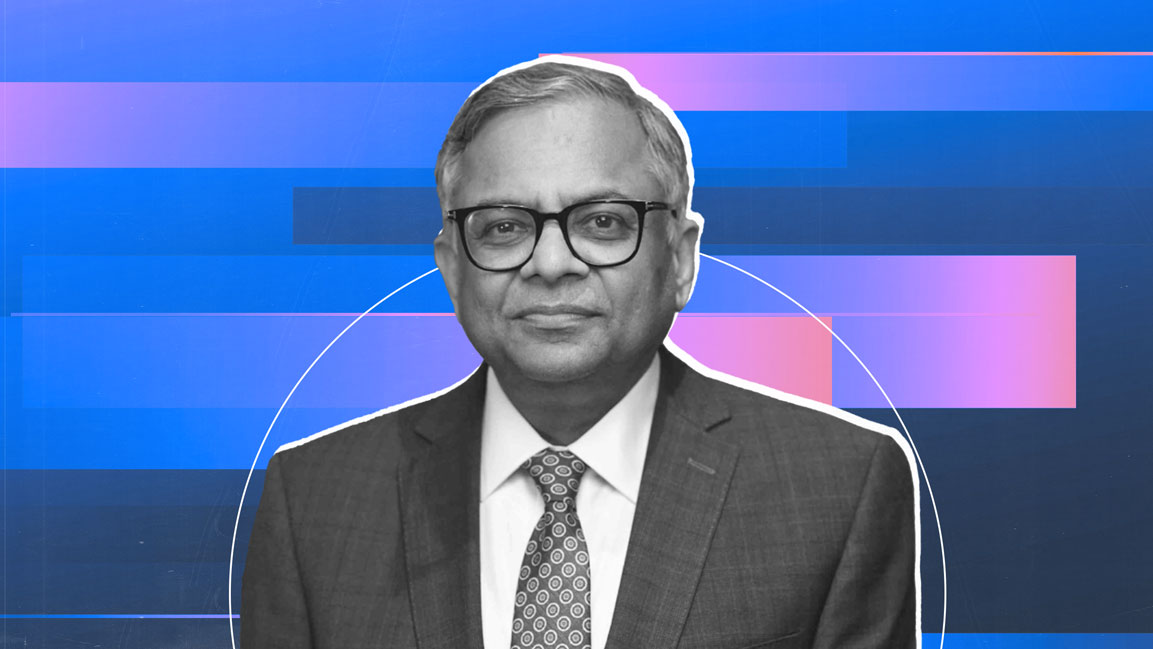

[Image creative: Chetan Jha/MITSMR India]

Tata Trusts has cleared a third term for N. Chandrasekaran as chairman of Tata Sons in a break from the group’s usual policy that executives step down at 65, Moneycontrol and The Economic Times reported, citing people aware of the development.

The resolution, passed at a 11 September meeting, was reportedly proposed by trustees Noel Tata and Venu Srinivasan, citing the need for continuity as Tata navigates strategic transitions.

Chandrasekaran first became chairman in 2017 after joining the Tata Sons board in 2016, and was reappointed for a second five‑year term in 2022, which will end in February 2027 when he turns 65.

The Trusts’ decision would extend his executive role beyond conventional retirement norms, though formal ratification by the Tata Sons board is expected.

The move occurs amid an internal dispute within Tata Trusts that surfaced dramatically in September, when four trustees, led by Mehli Mistry, opposed the reappointment of Vijay Singh as a nominee director on the Tata Sons board.

According to meeting minutes reviewed by Moneycontrol, the dissenting bloc proposed replacing Singh with Mistry, arguing a “more forceful voice” was needed to represent Trusts’ views.

Singh later resigned. He told The Indian Express that putting internal Trusts decisions to vote was “unprecedented.”

“Ratan Tata was very firm that there should always be consensus and unanimity on issues… perhaps we are now in a different era,” he said.

Reports also indicate that a clause requiring Tata Sons to seek Trusts’ approval for investments above ₹100 crore ($11 million) has not always been honoured, a point of friction between the operating company and its principal shareholder.

Government concern has reached senior levels. Reuters reported that home minister Amit Shah and finance minister Nirmala Sitharaman met with key figures, including Noel Tata, Chandrasekaran, and trustees Darius Khambata and Venu Srinivasan, urging an internal resolution to the standoff.

The rift pits two factions inside the Trusts. One side is led by Noel Tata, backed by Srinivasan and Singh, emphasizing continuity and consensus.

The opposing side, aligned with Mehli Mistry, includes trustees Pramit Jhaveri, Jehangir H.C. Jehangir and Darius Khambata, pushing for more assertive oversight of Tata Sons.

Mistry, a cousin of the late Cyrus Mistry, is also tied to the Shapoorji Pallonji (SP) Group, which holds an 18.37% stake in Tata Sons.

SP has been pressing for an IPO of Tata Sons to monetize its stake, while Trusts leadership has argued that a public listing would dilute its control.

Tata Sons missed an RBI deadline of 30 September for a potential IPO, which some SP stakeholders saw as an exit opportunity.

In the name of consensus, Tata has long governed by quiet alignment rather than public contest.

But the current standoff, including casting internal votes, proposing direct replacements, and involving ministers, echoes the contentious 2016–18 phase involving Ratan Tata and Cyrus Mistry.

While this round remains more discreet, it may reshape how authority is exercised within India’s most storied conglomerate.