Cyberattack Puts Brakes on Jaguar Land Rover Sales

A late production restart, tariff pressure and model transitions converged to pull down sales at the Tata Motors' subsidiary across North America, Europe and China.

News

- CES 2026 Day 2 Signals AI’s Shift From Platforms to Physical Systems

- Musk’s xAI Raises $20 Billion in Upsized Funding Round

- Agentic AI Will Reshape Customer Service, but Gaps Remain, Study Says

- Accenture To Buy UK AI Group Faculty In Billion Dollar Deal

- Microsoft Acquires Osmos to Embed Agentic AI into Fabric

- CES 2026 Opens With AI at the Center of the Global Tech Stack

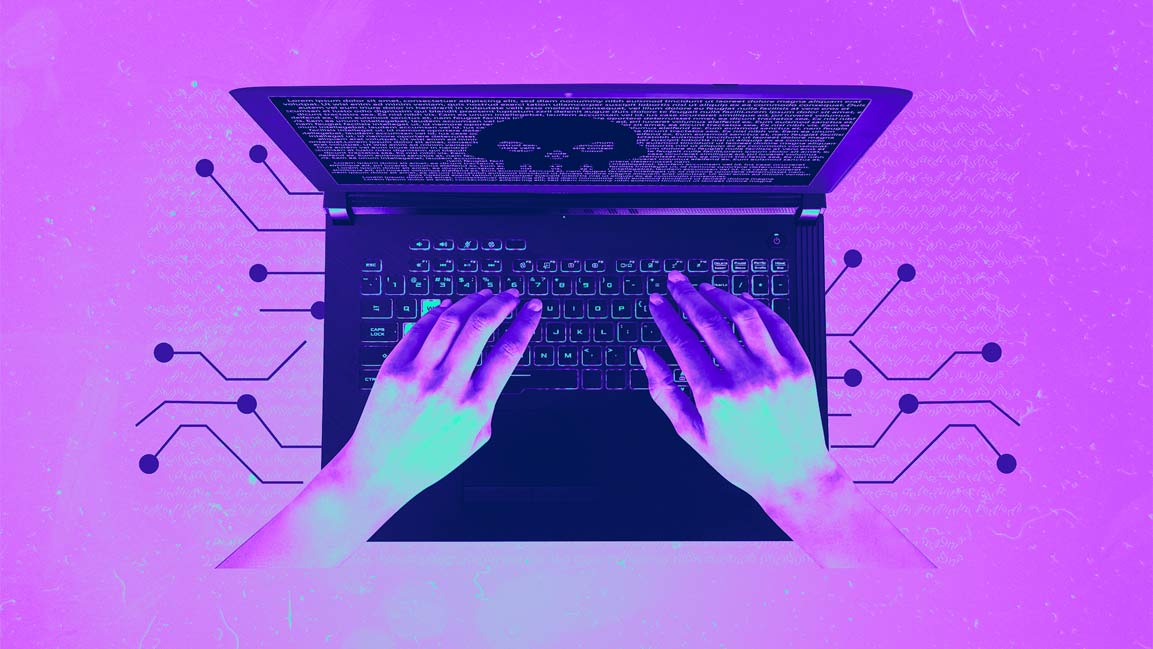

Jaguar Land Rover Automotive Plc reported a sharp drop in wholesale and retail vehicle sales for the December quarter, as production disruptions from a cyberattack, the wind-down of legacy Jaguar models and higher US trade barriers weighed on volumes across key markets.

Jaguar Land Rover, owned by Tata Motors Passenger Vehicles Ltd (formerly Tata Motors Ltd), said wholesale volumes for the third quarter of FY26 fell 43.3% from a year ago to 59,200 vehicles, while retail sales declined 25.1% to 79,600 units. The figures exclude wholesale volumes from its China joint venture but include retail sales from the partnership.

The company said production returned to normal levels only by mid-November after a cyber incident disrupted operations earlier in the quarter, delaying manufacturing and global distribution. The fallout from the attack compounded existing pressures from planned model transitions and external trade shocks.

“Volumes in the quarter were initially impacted by production stoppages following the cyber incident and the time required to distribute vehicles globally once production restarted,” JLR said in its statement dated 5 January

The cyber incident, first disclosed earlier this fiscal year, forced temporary shutdowns at several production facilities and disrupted internal systems, according to the company. While JLR did not provide details on the nature of the breach, it said operational recovery was gradual, with knock-on effects extending well into the quarter even after factories restarted.

The delayed recovery meant that vehicles produced after the restart could not be shipped and delivered at normal pace, dragging down wholesale dispatches and retail availability across regions, the company said.

JLR added that production stabilized only halfway through the quarter, leaving insufficient time to fully clear backlogs before the December quarter ended.

North America hit hardest

The sales slowdown was broad-based, with wholesale volumes declining across all major markets. North America recorded the steepest drop, with wholesales down 64.4% year on year. Europe saw a 47.6% decline, China fell 46%, and overseas markets slid 50.4%. UK wholesales were relatively resilient, slipping 0.9% from a year earlier

Retail sales followed a similar pattern. North America retail volumes fell 37.7%, Europe dropped 26.9%, China declined 18.4%, and the UK slipped 13.3%. Retail volumes for the first nine months of the fiscal year fell 19.1% to 259,400 vehicles

Product mix cushions impact

Despite the volume decline, JLR said demand remained concentrated in its high-margin models. Range Rover, Range Rover Sport and Defender together accounted for 74.3% of wholesale volumes in the quarter, up from 70.3% a year earlier, though slightly lower than the prior quarter’s mix.

The company said the continued wind-down of legacy Jaguar models ahead of the launch of a reimagined all-electric Jaguar lineup also weighed on volumes, as expected.

JLR said incremental US tariffs on exports to the US further constrained volumes during the quarter. The company ships vehicles from the UK and Europe into the US, one of its largest markets, leaving it exposed to changes in US trade policy.

Wholesale volumes for the first nine months of FY26 fell 26.6% year on year to 212,600 units, reflecting the combined impact of operational disruptions, model transitions and trade headwinds.

JLR said it will report full financial results for the quarter in February.

The volume data disclosed is provisional and rounded to the nearest hundred units, with detailed figures to be published later this month, the company said.